Rouen, France, December 14, 2020 — Robocath, a company that designs, develops and commercializes cardiovascular robotic systems for the treatment of vascular diseases, today announces that it has appointed Chantal Le Chat as an independent member of the Strategic Committee.

Chantal boasts 35 years of skill and know-how built up while working a range of posts at imaging major player GE Healthcare. Over the last six years, she has occupied key strategic roles in the company’s Interventional Division, including Global GM. Her duties as an independent member of the Strategic Committee will include supporting the governance of Robocath. She will use her extensive knowledge of imaging systems to analyze strategic opportunities for promoting interoperability of equipments used in cath labs, in particular compatibility with R-One™, the first robotic platform, as well as future robotic generations.

Philippe Bencteux, President and founder of Robocath, said: “I’m honored that a leader in medical interventional imaging such as Chantal shares our vision for robot-controlled vascular operations. I’m excited to welcome her to the Strategic Committee. Her impressive experience will be key in advancing future developments at Robocath.”

Lucien Goffart, CEO of Robocath, added: “I’m also delighted that we’ve been able to boost our Strategic Committee by appointing Chantal. The sector is currently seeing significant changes, with the advent of new technologies that promise significant added value. Robotics makes up a key part of this trend, and new robotic projects will need to predict and embrace changes in the sector in order to ensure that they remain relevant in the market over the medium and long term. Chantal’s experience, working for a leading imaging company, will help us to quickly identify which technological development opportunities to focus on in order to speed up implementation and lock in growth.”

Chantal Le Chat, Independent Strategic Committee Member of Robocath, said: “I’m happy to be joining the Strategic Committee at Robocath. I’ve been following the company and its progress for a number of years, and I’m especially impressed with the strides it has taken since being awarded CE marking for its first robot in February 2019. The company is now right at the heart of a revolution in interventional medicine, which comes with a number of benefits for physicians, such as greater comfort and complete protection from X-rays, while the level of precision a robot can deliver is a boon for patients. Robocath’s commercial expansion is highly promising and, with its integration in the cath lab, the product should see significant growth. I’m looking forward to using my experience to help the company achieve its goals.”

Chantal Le Chat joined GE Healthcare in 1985 as an engineer. She then held various leadership roles in Engineering within the XRays tubes as well as the Vascular organization based in Buc (France) or Milwaukee (Wisconsin, US). In 2000, she moved to the Service organization, leading Service Operations for EMEA before becoming in 2002 the Service GM for France-Belgium-Luxemburg. In this role, she drove customer satisfaction, operational excellence and profitable growth. In 2005, Chantal was promoted to EMEA Product GM for Surgery, Interventional & XRays and successfully developed the business for five years. In 2010, she became the Global Segment GM for Premium Angiography and Hybrid-OR. In this role, she drove market creation as well as introduced disruptive products and applications such as the Discovery IGS 7 platform. In mid-14, she expanded her role to cover also the CardioVascular segment and became the Global GM for Interventional. Chantal holds an Engineering degree in Physics from the “Ecole Supérieure de Physique et Chimie Industrielles” (ESPCI) and a Master in Medical Instrumentations, Paris France – 1985.

ABOUT ROBOCATH

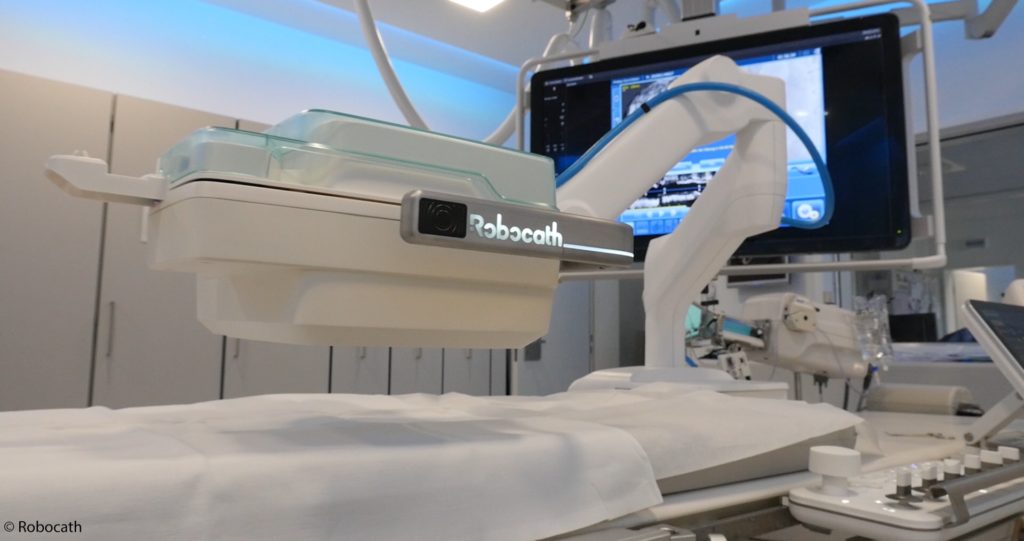

Founded in 2009 by Philippe Bencteux, MD, Robocath designs, develops and commercializes robotic solutions to treat cardiovascular diseases. As an active player in the evolving medical robotic industry, these innovative solutions aim to make medical procedures safer thanks to reliable technologies, while complementing manual interventions.

R-One™ is the first solution developed by Robocath. It uses a unique technology that optimizes the safety of robotic-assisted coronary angioplasty. This medical procedure consists of revascularizing the cardiac muscle by inserting one or more implants (stents) into the arteries that supply it with blood. Every 30 seconds, somewhere in the world, this type of procedure is performed.R-One is designed to operate with precision and perform specific movements, creating better interventional conditions. Thanks to its open architecture, R-One is compatible with market-leading devices and cath labs.

In a prospective, randomized, controlled pre-clinical trial, R-One demonstrated safety and efficacy as it achieved 100% technical procedure success and no MACE (Major adverse cardiovascular events). R-One received the CE marking in February 2019 and started its clinical application in September 2019. Currently R-One is available in Europe and Africa.

Robocath aims to become the world leader in vascular robotics and develop the remote treatment of vascular emergencies, guaranteeing the best care pathway for all. Based in Rouen, France, Robocath has more than 40 employees.

Rouen, France, November 2, 2020 – Robocath, a company that designs, develops and commercializes cardiovascular robotic systems for the treatment of vascular diseases, today announces creation of the joint venture with MicroPort Scientific Corporation ‘MicroPort’, through ‘MedBot’, its MicroPort MedBot (Shanghai) Co. Ltd subsidiary. This strategic partnership will enable the commercialization in China of its first robotic-assisted platform, R-One™. Both companies will also carry out research and development activities as agreed per the terms of the investment announced in April 2020. Robocath will hold 49% of this joint venture, 51% will be owned by MedBot.

Through this deal, Robocath will begin the commercialization of its first robotic-assisted platform in China, today the world’s biggest market in interventional cardiology. This expansion will be facilitated by local manufacturing of consumables and robotic assembly to ensure optimal distribution of Robocath products in this market. The testing, clinical and regulatory activities required to receive National Medical Products Administration (NMPA) approval for R-One will begin immediately. Both companies will also carry out research and development activities related to the next long-distance generation of remote control over 5G network technologies and will develop artificial intelligence algorithms to be used with robotic-assisted platforms.

“We are excited to take this new step in our development which will permit us to rapidly penetrate the sector’s leading market,” said Philippe Bencteux, chairman and founder of Robocath. “We are impressed with the resources made available by our partner to fast-track the approval of our product in China.”

“Since the announcement of our strategic partnership last April, we have strengthened our discussions with all of the Robocath team in order to establish this common structure which will undoubtedly ensure the commercial success of the R-One robotic-assisted platform in the Chinese market,” said Dr. Alex He, general manager of MedBot.

“We are looking forward to starting this collaboration. Together, we share the conviction that the future of interventional medicine is based on robotics and artificial intelligence. Over the next few years, this strategic partnership will enable us to accelerate our commercial deployment and strengthen our technological know-how to make Robocath a major global player in the field of vascular robotics,” added Lucien Goffart, CEO of Robocath.

ABOUT MEDBOT

Founded in 2014, MedBot develops intelligent surgical robotic systems and solutions. MedBot is committed to meeting the most cutting-edge development needs of minimally invasive surgery, and innovatively providing integrated intelligent surgical solutions that can save patients’ lives or improve their quality of life. Following years of research and development, innovation and industrial accumulation, MedBot has grown to become a medical robot company that masters the underlying technology in the entire chain. MedBot’s three flagship products in the three major segments, namely the Toumai™ laparoscopic surgical robot, Skywalker™ joint replacement surgical robot and DFVision™ three-dimensional electronic laparoscope, have entered the special approval procedure (Green Path) for innovative medical devices at the National Medical Products Administration (NMPA), becoming the only surgical robot company with three ‘Green Path’ grants in the People’s Republic of China (PRC). Its current business covers five areas, including endoscopy, orthopaedics, vascular intervention, natural orifice, and percutaneous puncture.

ABOUT MICROPORT

MicroPort® was founded in 1998 in ZJ Hi-Tech Park in Shanghai China, where a group of dedicated individuals joined together by the common belief that advancements in medical technology could transform patients’ lives in China and around the globe. Over the last two decades, MicroPort® has taken important steps towards fulfilling its mission of providing access to the best means of prolonging and reshaping lives.

Today, MicroPort® is focused in covering 10 major areas including Cardiovascular Intervention & Structural Heart Diseases, Electrophysiology & Cardiac Rhythm Management, Orthopedics & Soft Tissue Repair, Endovascular & Peripheral Vascular Diseases, Neurovascular Intervention & Neurosciences, Life Sciences (Endocrine Management), Surgical Devices & Medical Robotics, Urology & Gynecology & Respiratory & Gastroenterology, Aesthetics & Rehabilitation, and In vitro Diagnostics & Medical Imaging.

Thanks to over 300 MicroPort® devices currently approved for use in nearly 10,000 hospitals worldwide, one of our devices is used every six seconds. With a vast global footprint of R&D and manufacturing sites (Shanghai; Memphis, TN in the United States; Clamart in France; Saluggia in Italy; Santo Domingo in the Dominican Republic), a strong focus on technology innovation with over 4,700 patent applications, and a global workforce of over 7,000 employees, MicroPort® is committed to its vision of building a People Centric Consortium of companies focused on Emerging Medical Technologies.

ABOUT ROBOCATH

Founded in 2009 by Philippe Bencteux, MD, Robocath designs, develops and commercializes robotic solutions to treat cardiovascular diseases. As an active player in the evolving medical robotic industry, these innovative solutions aim to make medical procedures safer thanks to reliable technologies, while complementing manual interventions.

R-One™ is the first solution developed by Robocath. It uses a unique technology that optimizes the safety of robotic-assisted coronary angioplasty. This medical procedure consists of revascularizing the cardiac muscle by inserting one or more implants (stents) into the arteries that supply it with blood. Every 30 seconds, somewhere in the world, this type of procedure is performed.

R-One is designed to operate with precision and perform specific movements, creating better interventional conditions. Thanks to its open architecture, R-One is compatible with market-leading devices and cath labs.

In a prospective, randomized, controlled pre-clinical trial, R-One demonstrated safety and efficacy as it achieved 100% technical procedure success and no MACE (Major adverse cardiovascular events). R-One received the CE marking in February 2019 and started its clinical application in September 2019. Currently R-One is available in Europe and Africa.

Robocath aims to become the world leader in vascular robotics and develop the remote treatment of vascular emergencies, guaranteeing the best care pathway for all.

Based in Rouen, France, Robocath has more than 40 employees.

Caen, 1 October 2020.

UbiPlug, a young company in the field of medical technologies based in Caen, was founded in 2017 by Dr. Sylvain Thunder (President) and Eric Jean (Managing Director). It conceives, develops and markets innovative medical devices designed to reduce infections in the field of hemodialysis. Initially financed by its founding members and Business Angels, the company raised €800,000 thanks to an initial fundraising with a financing round led by GO CAPITAL, with the participation of NCI (WaterStart Capital) and Caisse d’Epargne Normandie. This fundraising will be supplemented by French and European public aid, and especially by Bpifrance, amounting to 1 million euros.

These funds will allow UbiPlug to accelerate the industrialization of its products and to finalize the regulatory procedures necessary to launch its first product on the market, “uPlug,” expected in September 2021.

AN INNOVATIVE DEVICE TO IMPROVE HEMODIALYSIS TREATMENT AND DEVELOP HOME CARE

“UPlug” is a single use connector allowing a simplified and secure connection between the patient and the hemodialysis machine. The device, with its system of patented valves, was designed to reduce the number of infections in patients treated with hemodialysis, and to facilitate a home installation of the treatment of end-stage renal failure by hemodialysis.

The technology developed by UbiPlug allows caregivers to connect the hemodialysis machine to the patient without any direct contact between their hands and potential zones of contamination. The benefits of this technology are numerous: uPlug will reduce by at least 50% the infections affecting patients being treated by hemodialysis, and lower the mortality rate as well as the cost of the treatment for healthcare systems.

A partner of UbiPlug since its creation, the company Air Liquide will distribute its products through its Meditor subsidiary. Meditor is a French lead distributor of dialysis membranes, and will thus supplement its offer with the Uplug innovative device.

“After three years of development, we are thrilled to welcome these new financial partners at UbiPlug’s capital; it will be an undeniable asset to accelerate the development of our company’s project,” commented Dr. Sylvain Thuaudet and Eric Jean, UbiPlug’s founders.

“The high technicality of the device developed by UbliPlug, paired with its simplicity of use and the benefits it brings to patients and caregivers, convinced us to get involved and to invest in it through our seed capital fund GO CAPITAL Amorçage II,” added Bruno Guicheux, Investment Director at GO CAPITAL.

“Hemodialysis is an especially heavy and difficult treatment for the affected patients. UBIPLUG’s innovation, which relies on a proprietary technology, matches the profile of medical technologies with high added values that we support,” remarked Yves Guiol, Director of WaterStart funds at NCI.

“Caisse d’Epargne Normandie is strategically looking at new opportunities with an open mind, and wishes to become a lead actor in regional investments in the field of innovation with a strong impact potential (#techforgood): the innovation developed by Dr. Sylvain Thuaudet and Eric Jean, because it improves the living conditions and the care provided to patients of hemodialysis, upholds our values,” concluded Christophe Descos, a member of the management board in charge of the Finance division of Caisse d’Epargne Normandie, and the president of the Investment Committee.

Nantes, France, October 7, 2020 – Nextflow Software, a startup spun off from Centrale Nantes technical institute, just closed a first round of financing for a total amount of three million euros. This Series A round will allow Nextflow to accelerate the sales of its innovative numerical simulation software and continue its international development.

This operation includes 2 million euros equity investment from French funds Ouest Ventures III and Litto Invest managed by GO CAPITAL, and 1 million euros loans from French public bank Bpifrance and private bank CIC Ouest.

Accelerating the international development of Nextflow

Nextflow has already strong partnerships with French major industrial accounts such as Renault, Michelin, Dassault Aviation, Airbus, EDF. This financing round will allow Nextflow to export its software to other countries and accelerate its commercial development.

The startup initiated a first network of resellers in Asia and already met its first success in Japan and South Korea with the signature of a license agreement with LG Corp in September 2020. This new financing will help Nextflow conquer new markets in Europe, North America, and continue its expansion in Asia.

“Nextflow has developed for many years an innovative technology that now reaches industrial maturity and meets its first customers. GO CAPITAL plays its role by helping deep-tech startups in their international growth”, says Jérôme Guéret, General Manager of GO CAPITAL. “We are proud to support Nextflow’s excellent team in its new development stage.”

Broadening the application domains of fluid dynamics simulation, by making it simpler, faster and more accurate

Based on new Computational Fluid Dynamics (CFD) methods, Nextflow’s software has been co-developed for more than 10 years with Centrale Nantes, French CNRS and Italian CNR. These numerical simulation tools are revolutionary because their “meshless” nature allows them to:

“Nextflow provides revolutionary software to the fluid dynamics simulation domain. We bring to the market innovative methods that push the limits of numerical simulation and democratize its use for most designers of industrial products, systems and equipment”, says Vincent Perrier, CEO of Nextflow Software. “We are delighted by the confidence that GO CAPITAL shows in our team and project, and we will leverage this first round of financing to reach out to all industries dealing with fluid flows.”

Today, Nextflow has about 20 employees, mostly engineers and doctors, who include some of the world-experts in meshless CFD, as shown by the international awards won by the company.

The startup was created in 2015 by Erwan Jacquin, PhD in CFD, founder of a first successful startup spun off from Centrale Nantes and named HydrOcean. Nextflow is part of Centrale Nantes incubator and has Centrale Innovation as a shareholder. The company is managed by Vincent Perrier, who’s also a serial entrepreneur.

About Nextflow Software

Nextflow Software is an Independent Software Vendor (ISV) startup headquartered in Nantes, France. Nextflow develops and sells advanced Computer-Aided Engineering (CAE) software in the field of Computational Fluid Dynamics (CFD).

Nextflow Software addresses engineering companies developing and manufacturing products and systems involving complex fluid flows in the field of automotive, aeronautics, marine, energy, manufacturing, and many other industries.

Thanks to its talented team of researchers and engineers, based on more than 10 years of close partnership with leading academic research laboratories from Ecole Centrale Nantes (ECN) and other universities, Nextflow Software is pushing the limits of hydrodynamics simulation.

Contact: vincent.perrier@nextflow-software.com

Paris, October 1st, 2020 – Acticor Biotech, a clinical stage biotechnology company involved in the acute phase of thrombotic diseases, including acute ischemic stroke, today announced the completion of its ACTIMIS Dose Escalation Phase of Glenzocimab Study as add-on to standard of care in Patients with acute ischemic stroke.

This Dose Escalation Phase was successfully completed with 60 patients enrolled from 6 European countries (France, Belgium, Germany, Spain, Switzerland and Italy).

5 cohorts of patients presenting with an acute ischemic stroke episode of moderate to severe intensity were enrolled in this study and randomly received glenzocimab at one of 4 ascending doses or a placebo, in a blind fashion as a 6-hour single-dose infusion. Patients were evaluated continuously for 24 hours, then 7 and 90 days after the episode. Approximately 50% were also treated with the thrombolytic agent rtPA (ACTILYSE®), and the other 50% received rtPA and underwent a mechanical thrombectomy. The DSMB met on 5 occasions in between each cohort and at the end of the last administration, and they analyzed the safety data with a particular focus on the advent of intra-cerebral hemorrhages and other bleeding related events. The last analysis performed after the target dose of 1000mg had been administered to 12 patients confirmed both the absence of increased bleeding when glenzocimab is added to rtPA and to rtPA and thrombectomy, and the absence of any dose-related trend in the number and nature of adverse events recorded.

The green light received from the DSMB will allow ACTICOR to launch the second part of this ACTIMIS study (phase 2) in an additional 100-patient group dosed and randomized with either 1000mg of glenzocimab or its matching placebo. It will also allow starting other clinical projects at this selected dose, which will address other acute ischemic stroke population subsets under various therapeutic options.

“We are very pleased to have completed the dose escalating phase of ACTIMIS in a pathology were most drug candidates have failed in the past years for safety reasons and specifically due to a higher bleeding risk. This is an important milestone for the company and an important progress in the emergency treatments of ischemic stroke. Glenzocimab is a first-in-class treatment in this indication, where no new treatment has been approved in recent decades.” says Dr Gilles Avenard, CEO and founder of Acticor Biotech.

About glenzocimab (ACT017), the Therapeutic Candidate

Acticor is developing glenzocimab (ACT017), a humanized Antibody Fragment (Fab). The therapeutic candidate is directed against a novel target of major interest, platelet glycoprotein VI (GPVI), and inhibits its action. Evidence of antithrombotic efficacy of glenzocimab and safety of inhibition of GPVI have been established both ex vivo and in vivo. The target is involved in the growth of the thrombus, but not in physiological haemostasis. This limits the bleeding risk associated with its inhibition.

https://acticor-biotech.com/technology/

About Acticor Biotech

Acticor Biotech is a clinical stage biotechnology company, spin-off of INSERM, dedicated to developing an innovative treatment in the therapy of acute thrombotic diseases, including ischemic stroke. Acticor Biotech is built upon the expertise and the results of research conducted by the founders: Dr. Martine Jandrot-Perrus at INSERM Paris and Pr. Philippe Billiald at Paris-Sud University.

Acticor Biotech is a partner in the BOOSTER consortium, dedicated to the management and new treatments of cerebrovascular accidents (CVA) in emergency situations.

Acticor Biotech is backed by a syndicate of European and International investors: Karista, Go Capital, Newton Biocapital, CMS Ventures, Mirae Asset Capital, Anaxago, Primer Capital & Armesa Foundation.

For more information, go to: https://acticor-biotech.com/

Funds will boost product development roadmap of new manufacturer in secure Rapid Transfer Systems for biopharmaceutical industry

Tours, France, June 29, 2020 – ABC Transfer, an industrial designer and manufacturer of secure Rapid Transfer Systems (RTS) for the biopharmaceutical industry, today announces it has raised €3 million ($3.2M) in a series A financing round. Go Capital, an investment fund management company and representative of the Loire Valley Invest Fund, led the round; with Bpifrance, the French national bank, and the regional government of Centre-Val de Loire contributing grants and loans.

The success of this first tranche of funding reflects investor confidence in ABC Transfer’s business model and leadership team, as well as strong interest in the market opportunities that its aseptic transfer systems will be addressing. Growth of the pharmaceutical industry and the rise in research and development are likely to drive the demand for aseptic filling, thus boosting the global aseptic transfer system market[1]. The drug manufacturing shift to smaller and more flexible production lines is expected to impact growth for these systems.

ABC Transfer will use the funds to accelerate the development of its ABC Transfer® system, that improves 50 features, launch in Q4/2020 a new brand of Rapid Transfer Ports (RTP), especially designed for the biopharmaceutical industry, and gear up production. It will also strengthen its R&D activities, maintaining a budget of at least 15% of its turn-over over the long term.

“ABC Transfer is thrilled to have secured this investment. We would like to thank Go Capital, Bpifrance, the Centre-Val de Loire region and the Metropole de Tours for their support, confidence in our leadership and long-term commitment to our project,” said Thierry Girard, CEO of ABC Transfer. “Achieving this strong financial backing means that we will be able to roll out a complete range of Rapid Transfer System solutions, eagerly awaited by customers, and position our products as true innovations within biopharmaceuticals. The benefits of our high-performance and ergonomic designs include ultra-cleanliness, GMP compliance, safety and security. We look forward to raising awareness with customers of these and a host of revolutionary RTS system features.”

The safe manufacture of pharmaceutical drugs requires perfectly sterile and particle-free environments. An RTP, which consists of special double containment doors that are integrated into an isolator, is a system that allows the safe transfer of substances used in drug development, such as Active Pharmaceutical Ingredients (API) or vaccines.

ABC Transfer collaborated with a network of nine GMP industrial partners on resolving 50 shortcomings within its design that customers in production and maintenance identified in a feasibility study as deficient in currently available RTP and RTS solutions. Designed from scratch and protected by 12 patents, the ABC Transfer system is the very first of its kind to satisfy all the demands in RTS for biopharmaceutical manufacturing.

‘Go Capital is proud to accompany ABC Transfer’s management team on this project. It is set to become one of the major manufacturers of equipment and consumables for aseptic transfer chains, thanks to its significant breakthrough in innovation and large portfolio of patents,” said Herve Bachelot-Lallier, investment director of Go Capital. “The rich experience of the team, the dynamics of the sector and the need for quality in the pharmaceutical industry are assets favorable to ABC Transfer’s success.’’

ABC Transfer was co-founded in June 2019 by Thierry Girard, who is also its CFO and CCO, and Jean-Luc Schneider, its COO and CTO. They have decades of technical and executive management experience in the life sciences, specifically in RTS solutions.

Customers are currently sampling products. ABC Transfer plans to launch its first product in the fall.

[1] https://www.transparencymarketresearch.com/aseptic-transfer-system-market.html

June 18, Rennes. Quortex, provider of a video streaming solution over the Internet, raises 2.5 millions euros in seed capital, in a funding round led by Elaia and GO CAPITAL, with the participation of Unexo and Business Angels. The Quortex’ software solution is already used by customers such as M6 or Red Bee Media.

Make Video Streaming over the Internet more reliable and cost-effective, while improving the user experience

This funding round will enable Quortex to widen its technological advantage by extending its “Just In Time” platform. Fully developed in the cloud, the solution is built as a logical combination of microservices that automatically organize themselves according to the network events and audience variations.

“Rather than processing content without knowing if someone will watch it and therefore consuming resources inefficiently, our solution is close to customer needs, offering massive scaling if necessary, but also reducing the carbon footprint to a bare minimum when needed.” says Jérôme Viéron, CTO of Quortex.

Current state of the art technologies can’t sustain the market growth

This fundraising occurs in a very unique context. On the one hand, the number of streaming platform subscribers has doubled in a few months (accelerating the growth of a global 40 billion dollars market), while on the other this sudden rise highlighted the technological limits of existing systems that can’t operate at such scale (leading to bitrate reduction for subscribers). The 2024 Olympics in Paris will be the first event where the streaming audience is expected to be higher than traditional broadcasting.

Turn a technical threat into a business opportunity

“Streaming is often seen as a threat for the Internet as it uses up to 80% of its worldwide capacity” adds Marc Baillavoine, Quortex CEO. “It should be seen as a unique opportunity and the streaming technical constraints must be exploited: our patented technology makes it possible to suit subscribers’ personal preferences, both in terms of video quality and in content, and to create as many television channels as there are subscribers.”

Make streaming a new television

Marc Baillavoine, Jérôme Viéron, Julien Villeret and Thierry Trolez, the 4 co-founders of Quortex joined forces in September 2018 around this vision that the technology needs to be re-designed from scratch to meet the challenges of live streaming at scale.

Anne-Sophie Carrese, partner at Elaia: “We were convinced by this deep tech, serial entrepreneur team that developed a highly innovative solution with an impressive demonstration: live streaming at scale with an intuitive ergonomy. The addressable market is huge with the mass increase for video content, on-demand, even for Live. Finally, their cloud-native solution, built to run on the edge (closer to the end user) perfectly fits with the current cloud trends.”

Bertrand Distinguin, investment director at GO CAPITAL: “We have been seduced by the expertise and the know-how of that team that developed a disruptive technology that answers new video consumption trends. Their “Just-In-Time” platform allows live streaming content using resources that adapt to the audience dynamics. This innovation leads to an improved User Experience while massively reducing the carbon footprint”.

Mélanie Hébert, investment director at Unexo: “Rennes is one the worldwide focal point in video technology Research and Development. We are delighted to back the Quortex founders, convinced by their solution and their ability to address the challenges of this highly changing market. Our role, as part of the Crédit Agricole, is to support the advent of worldwide leaders in our territories and this operation is a perfect example.”

About Quortex

Created in 2018, Quortex’ streaming solution targets content owners and keeps infrastructure and network costs to a minimum, while dynamically adapting to audience variability. Quortex changes the paradigm of content delivery by introducing “Just In Time Everything”, a patented, A.I. based technology that builds the workflow based from the user demand, not from the content origination.

Rennes, 7 may 2020 – GO CAPITAL, investor in innovation capital, presents a very dynamic first trimester 2020, considering the number of investment operations and reinvestments realized. Go CAPITAL’s team is mobilized to support its participations and assist the most promising local deep tech companies during the crisis.

A first semester 2020 characterized by seven financing transactions

In the first trimester of 2020, GO CAPITAL realized 3 new investments amounting to 1.9 M€.

AKRYVIA, a start-up developing an innovative technology for metal cutting, joined GO CAPITAL’s portfolio in January. The investment files for ABC Transfer (development of a line of products used in the transfer chains of pharmaceutical industries) and ECOVELO (design and sales of technological solutions for light vehicles, electrical hybrids, and self-service) were finalized as well during the health crisis.

Furthermore, an amount of 0.42M€ was reinvested in four companies.

With these reinvestments, GO CAPITAL renewed its support to two innovative companies working in the field of medical and analytics technologies (TRICARES and DIAFIR), as well as two start-ups in the digital field (ANTIOTE and ALCUIN). Some of our refinancing operations will aim to support these companies during the COVID-19 health crisis.

Health crisis and investment prospects for the next trimester

“We consulted with the companies of our portfolio, in order to assess the consequences of the health crisis on their growth potential and their financial health during the next trimesters. Their treasury is obviously impacted by the situation, and we are planning to intensify our reinvestment policy to support the most promising start-ups. In the last couple of weeks, we have been monitoring the evolution of the regulatory measures affecting the profile of our participations on a case-by-case basis. Our action, now more than ever, seeks to inform, guide and support them in their decision-making and undertakings, in order to sustain their activity and to protect their treasury and the jobs that depend on it,” state Bertrand Distinguin and Jérôme Guéret, associate investment directors at GO CAPITAL.

As a responsible investor, GO CAPITAL also intends to sustain its investment policy towards the deep tech companies of the Grand Ouest region. In the coming months, the management company should be involved in four or five financing operations in the Grand Ouest region. We also anticipate reinvestments in companies already included in the current portfolio of the management company of an estimated amount of 2 to 3M€.

A closer look at some actors of the portfolio who managed to quickly reinvent themselves

Several star-ups supported by GO CAPITAL mobilize their skills and their energy to participate to the fight against the COVID-19 pandemic. Their activity quickly readjusted in order to respond to the growing demands of the general public and socio-economic actors.

BIOSENCY – The Rennes-based company is developing the first medical device of telemonitoring and prevention dedicated to patients suffering from chronic pulmonary insufficiency, and especially patients suffering from Chronic Obstructive Pulmonary Disease (COPD). The start-up will deliver 600 monitoring bracelets, thanks to the support of ASICA and Actuaplast. These connected bracelets were designed for the remote treatment of patients in respiratory distress and to facilitate their returning home. This medical device is especially useful to allow hospitals to free resuscitation beds and for the monitoring of inpatients as well as outpatients.

BIOSENCY is a participation of the GO CAPITAL Amorçage II fund.

SHOPOPOP – Based in Nantes, this start-up assists more than 800 stores in France (Leclerc, Système U, Intermarché, and more recently Auchan and Carrefour…). Their platform connects users who wish to share their shopping trips with others in order to buy groceries through drive-in services or in store. Since the beginning of the quarantine, we have witnessed a strong increase in the number of orders that were placed through Shopopop’s community of private individuals turned delivery drivers. As a safety measure, the platform does not allow deliveries with a direct contact between the delivery driver and the recipient. Stores are also encouraged to provide masks and gloves to delivery drivers. It is noteworthy that the star-up was recognized as a public utility service by the French government in March 2020.

SHOPOPOP is a participation of the GO CAPITAL Amorçage II fund.

VITEMONMARCHÉ – Also based in Nantes, this food distribution start-up proposes an innovative model to deliver fresh and local products directly from the producers and within the hour, thanks to mobile trucks. Only a few days after the beginning of the quarantine, Vitemonmarché had to reorganize in order to prepare 500 orders per day. They managed to set up a new tool to optimize delivery routes, to triple the surface of their cold storage, and to double their fleet of trucks in record time. The start-up currently employs 70 people (compared to 30 before the health crisis), and is expected to extend its services to other French cities in 2020. It should offer its services in Rennes as soon as May.

VITEMONMARCHÉ is a participation of the GO CAPITAL Amorçage II fund.

Paris, France, May 4, 2020 ‐ HORAMA, a clinical stage gene therapy company in ophthalmology, today announced the appointment of Dr. Ian Catchpole as its Chief Scientific Officer. Ian will draw on his 25-plus years of experience in drug discovery and development to oversee HORAMA’s scientific operations.

Ian has worked for over 25 years at GlaxoSmithKline (GSK) and its legacy companies, where he built an excellent reputation as both project initiator and leader, successfully attracting support and funding for many projects, taken from inception to early clinical/GMP development. At GSK, Ian also managed scientific, business and strategic operations of many programs, through partnerships with academic institutions and biotech collaborators. He has extensive knowledge in a wide range of areas, including ophthalmology, cell and gene therapy, vaccination and immuno-oncology. Ian is author of over 40 scientific articles and inventor on 17 patents. He is a Fellow of Royal Society of Biology (FRSB) and was an Inaugural GSK Fellow.

“We are delighted to announce Ian’s appointment as our Chief Scientific Officer. The depth of his knowledge of gene therapy and his experience in bringing novel biopharmaceutical approaches to clinical ophthalmology will be great assets to HORAMA. We look forward to working with him toward bringing our gene therapy products to ophthalmic patients,” said Christine Placet, CEO of HORAMA.

“I am honored to serve as HORAMA’s Chief Scientific Officer and I look forward to helping consolidate the company’s gene therapy leadership in ophthalmology, to advance our pipeline of clinical programs and to deliver best-in-class therapies for inherited retinal dystrophies,” said Ian Catchpole, CSO of HORAMA.

Before joining HORAMA, Ian worked as a consultant in ophthalmology, biopharmaceuticals, cell and gene therapy, immuno-oncology, novel therapeutics and drug discovery/delivery. He was previously Director of Research at TC Biopharm.

Prior to leaving GSK, Ian worked as a “Cell and Gene Therapy Discovery” Translational Leader. He was named a GSK Fellow in 2016 for his contributions to the company. He was previously program leader for both the sustained-release anti-VEGF for wet AMD and the anti-beta-amyloid Ab program – taken to the clinic for Geographic Atrophy – within GSK Ophthalmology. Ian also worked with AAV delivery of complement factors to the eye for dry AMD during GSK’s collaboration with Jim Wilson’s group. Ian won two scientific excellence awards for his contributions to ophthalmology and the delivery of Biopharms. Ian also led the Alternative Delivery Program of the Biopharm Vaccine Technology initiative at GSK where he helped secure over £1 million in total funding. Ian also worked for the Gene Therapy Group in the late 1990’s at Glaxo Wellcome. He joined the Glaxo Transgenic Group in 1993, after post-doc research at the Karolinska Institute in Sweden on embryonic stem cells and HSV-2 at Bristol University, UK.

Dr. Ian Catchpole has a D. Phil in Molecular Biology and received a B.A.(Hons) in Biochemistry from Oxford University.

Gene therapy market (source: FiorMarkets and Grand View Research, Inc)

Gene therapy is being developed with an aim to treat rare conditions with limited or no treatment options. Genetic disorders occur due to gene mutations, which can result in incorrect protein synthesis. Gene therapy is used to introduce a healthy gene into cells to allow the synthesis of a functional protein. Growing awareness and acceptance of gene therapy for various disease treatments are favouring market growth. The global gene therapy market is estimated to reach $5.5 billion by 2026, while the global ophthalmology market is projected to grow to $43 billion by 2026 (April 2019 report issued by Grand View Research, Inc.).

About HORAMA

At HORAMA, we believe in gene therapy to treat a broad range of inherited disorders. Our focus is on Inherited Retinal Dystrophies with our lead clinical program targeting patients with PDE6B gene mutations, a condition which leads to progressive vision loss in children and adults ultimately leading to legal blindness. Our team is pushing the boundaries of gene therapy by advancing next generation delivery platforms that will improve effectiveness and coverage of gene transfer to address multiple diseases. For more information, please go to: www.horama.fr.