Green Impulse develops new biocontrol solutions for agriculture to reduce the use of synthetic products and dependence on pesticides. The company markets a product that has also demonstrated its positive impact on pollinators.

A growing movement in favor of useful finance, aiming for measurable social and environmental impact, has accelerated in recent years. GO CAPITAL contributes to this transformation by developing a coordinated CSR approach with all its stakeholders.

Through its territorial network, GO CAPITAL has developed a deep understanding of its regions and their needs. Our goal is to contribute, through our investment choices and daily actions, to the major challenges of the ecological transition towards a low-carbon economy, as well as to the promotion of gender parity and the fight against inequalities in business. The Responsible Investor Charter and the Gender Parity Charter (France Invest), of which we are signatories, are a clear illustration of our commitments as a responsible investor.

We are signatories of several foundational charters in the responsible investment sector. These voluntary commitments reflect GO CAPITAL’s desire to integrate the consideration of extra-financial aspects into its overall investment process.

Since its inception, GO CAPITAL has been strongly present within the ecosystem through active participation in events (partnerships, selection committees for competitions, workshops, etc.), training programs, and juries at schools and universities, as well as through sponsorship activities.

As a major player in equity financing, GO CAPITAL supports companies in the midst of significant structuring phases, such as R&D, commercialization, and recruitment. The entrepreneurs we support are leading large-scale projects that will ultimately transform the economy of our regions and employment. We therefore have a responsibility to guide them over the long term in addressing these transformation challenges, particularly by integrating ESG policies at the core of our actions.

Green Impulse develops new biocontrol solutions for agriculture to reduce the use of synthetic products and dependence on pesticides. The company markets a product that has also demonstrated its positive impact on pollinators.

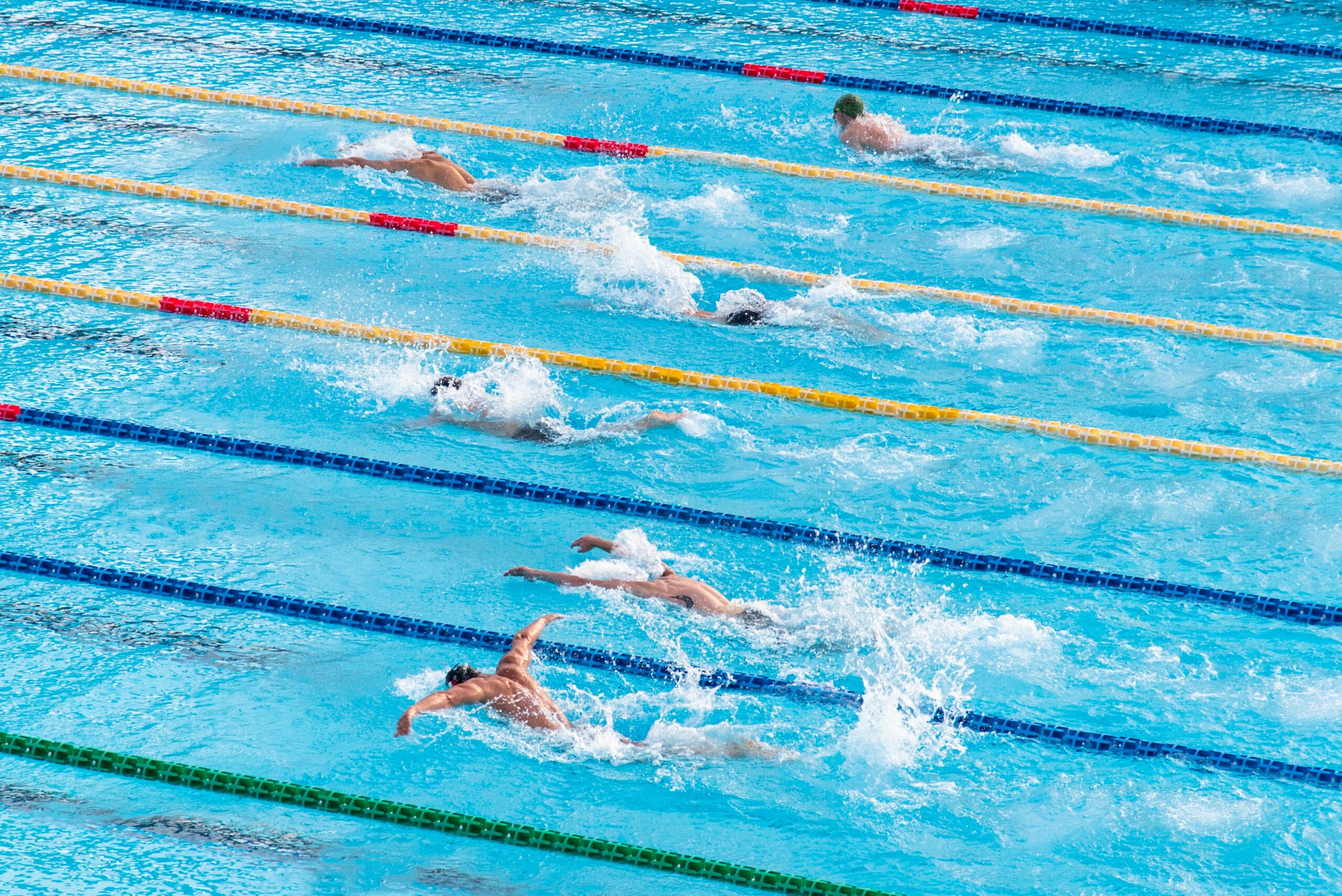

Aqualeg has developed a patented technology for realistic and highly durable Soft Shell prosthetic covers. Since its creation, Aqualeg has equipped several thousand patients. These patients can participate in social and sports activities during the summer or leisure activities without changing their prosthesis and without drawing attention.

In accordance with the implementing decree of Article 29 of the Energy-Climate Law (LEC) of November 8, 2019, published on May 27, 2021, GO CAPITAL discloses information related to the social, environmental (including climate change-related issues), and governance quality criteria considered in its investment policy.

This charter details the consideration of ESG criteria in GO CAPITAL’s investment policy as well as in the company’s management. This charter complies with the requirements of Article D 533-16-1 of the French Monetary and Financial Code.

The company GO CAPITAL has not made any PAI (Principal Adverse Impacts) commitments on behalf of the management company.

However, its fund “Impact Océan Capital,” a Article 9 SFDR fund, has made such commitments.